Simulating price setting

Many models for this process have been developed…

Many models for this process have been developed…

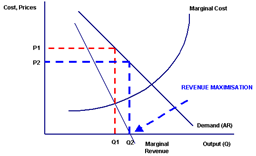

You work in a wholesale business and the purchase prices have changed. This happens all the time, but you want to stay in business. How do you make your best decisions? If you raise you know you might loose some customers, if you don’t you know your revenue will be hit. The problem of course is minor if prices go down, but this is more unusual.

My experience in this field is mostly from wholesales in the food industry. There Movex(M3) is the most common ERP-system used at least here in Sweden. You know you have all the facts you need at hand, but still many times you are pretty unsure if you do the correct changes to adapt. How much will our changes affect our revenue for this year?

My customers have agreements with their customer for half a year or for a quarter, when prices are supposed to be fixed. During this period unforeseen changes appear, exchange rates change, the harvest for some commodities fail due to whether conditions etc etc. So your revenue expectations change all the time. 2 to 4 times a year you have the chance to do adjustments, this is the process I will cover in some posts to follow. How to use Excel, Movex and a relational database to support this process to for helping you make the “best decisions”, or at least to a little bit better than your competitors.

My customers have agreements with their customer for half a year or for a quarter, when prices are supposed to be fixed. During this period unforeseen changes appear, exchange rates change, the harvest for some commodities fail due to whether conditions etc etc. So your revenue expectations change all the time. 2 to 4 times a year you have the chance to do adjustments, this is the process I will cover in some posts to follow. How to use Excel, Movex and a relational database to support this process to for helping you make the “best decisions”, or at least to a little bit better than your competitors.

Components in this “Movex-add in” are: collect relevant historical data, display three scenarios history, now and new. History is obviously what has happened during last year, now is the scenario where you do nothing and new is the scenario where you see what will happen with the changes you suggest. The model is Excel-based and you could easily specify three types of changes % on current price, % change on margin or exact amount per kg or unit. You could specify on a specific item or on a group of items, with Excel’s easy copy and past you make your changes category by category. Whenever you like to you ask the computer about the outcome so far by asking for a simulation. The simulation performed mimic most of M3’s rather complex price setting mechanism’s as price lists, discounts and bonus, based on current settings in M3. Then after each step you could analyse the result down to price list, customer group or a specific customer to see the outcome and to make feasible adjustments.

Components in this “Movex-add in” are: collect relevant historical data, display three scenarios history, now and new. History is obviously what has happened during last year, now is the scenario where you do nothing and new is the scenario where you see what will happen with the changes you suggest. The model is Excel-based and you could easily specify three types of changes % on current price, % change on margin or exact amount per kg or unit. You could specify on a specific item or on a group of items, with Excel’s easy copy and past you make your changes category by category. Whenever you like to you ask the computer about the outcome so far by asking for a simulation. The simulation performed mimic most of M3’s rather complex price setting mechanism’s as price lists, discounts and bonus, based on current settings in M3. Then after each step you could analyse the result down to price list, customer group or a specific customer to see the outcome and to make feasible adjustments.